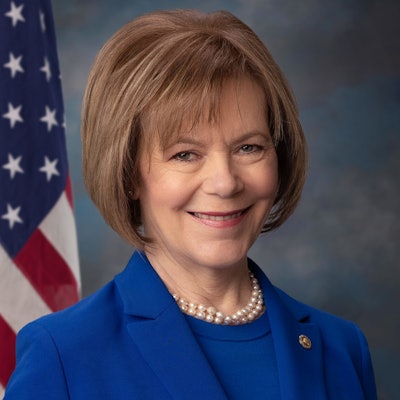

Sens. Tina Smith, D-Minn, and Chuck Grassley R-Iowa, have reintroduced three bills to help students and families make informed decisions about borrowing for college. Sen. Tina Smith

Sen. Tina Smith

The bills aim to make sure that students are informed and educated about college search and selection, loans, and financial aid.

The Net Price Calculator Improvement Act aims to improve effectiveness and access to net price calculators. The Understanding the True Cost of College Act would create a universal financial aid offer form and standardize terms used in financial aid.

And the Know Before You Owe Federal Student Loan Act would strengthen current loan counseling requirements for higher ed institutions, require loan counseling annually, and allow students to decide exactly how much they would like to borrow.

“We need to equip students and their families with better information about the costs of college from the initial college search to when they receive financial aid offers. My bipartisan bills with Sens. Grassley and Ernst would help fix these problems,” Smith said. “That includes improved net price calculators so students and families have estimates of college costs after taking into account scholarships and grants. We’ve got a plan to create a universal financial aid offer so students can easily compare financial aid packages between schools, which is important because time and again students are met with inconsistent and incomplete information. And we’ve introduced a bill to improve loan counseling. These reforms will help students make one of the biggest financial decisions of their lives—how to pay for college.”

Last year, the Government Accountability Office put out a report that colleges were misleading students, understating costs, and omitting key details about federal student aid.

“I often hear from Iowa families who are frustrated and confused by the complex student loan borrowing process. So much of the student debt conversation focuses on repaying debt. We ought to fix the process on the front-end before students get in over their head. The federal government should be offering commonsense resources to better prepare borrowers,” Grassley said. “These bills would provide additional counseling, resources and clarity to the student loan process so that America’s next generation of leaders can pursue higher education opportunities without breaking the bank.”