Just ahead of the return of student loans, borrowers can now apply for the Biden administration’s new plan to reduce monthly payments, the Department of Education (ED) announced Tuesday. The Saving on a Valuable Education plan (SAVE) is being touted by the administration as “the most affordable repayment plan in history.”

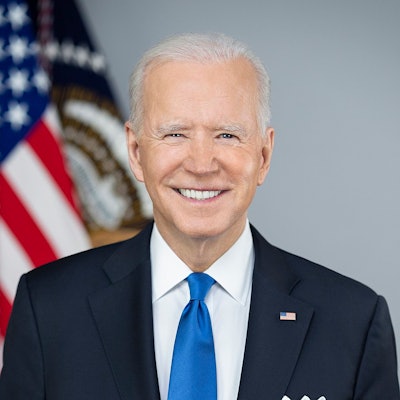

President Joe Biden

President Joe Biden

ED expects over 1 million low-income borrowers to qualify for $0 payments and estimates that 70% of borrowers on IDR plans will benefit from the unpaid interest provision. On average, payments will drop 40% per dollar borrowed. Borrowers with the lowest projected lifetime earnings would see an 83% reduction. ED expects that 85% of community college borrowers will be debt-free in 10 years, and that, on average, Black, Hispanic, American Indian, and Alaska Native borrowers will have their lifetime payments per dollar borrowed sliced in half.

The application is designed to be fast to complete, taking under 10 minutes. Borrowers can securely import their income data from the IRS and have it automatically recertified each year, removing the need to re-apply annually. Applicants will be able to see their new payment amount before submitting, and, if they qualify, can expect the new payment to take effect in October. Those who are currently enrolled in REPAYE plans will have their payments automatically adjusted to the SAVE plan.

ED also announced an outreach campaign to promote the new plans. The campaign will see the department partner with community organizations, including Civic Nation, the NAACP, the National Urban League, and the Student Debt Crisis Center, to host events and train advocates to raise awareness.

The details of the SAVE plan were announced immediately after the Supreme Court rejected Joe Biden’s plan to forgive up to $20,000 of student debt. Other actions that the administration has taken include the announcement of a temporary “on-ramp” period to spare borrowers the worst consequences of not keeping up with their loans when payments resume this fall, and forgiving $39 billion of debt for borrowers affected by ED’s failure to keep track of their payments. The administration has also announced that it will try to offer mass debt forgiveness under a different legal authority.

Jon Edelman can be reached at [email protected]