The Biden-Harris Administration has announced the approval of $7.4 billion in additional student loan debt relief for 277,000 borrowers, primarily eligible borrowers who signed up for the Saving on a Valuable Education (SAVE) Plan.

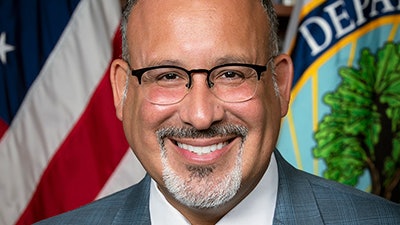

Dr. Miguel Cardona

Dr. Miguel Cardona

“Today’s announcement shows — once again — that the Biden-Harris Administration is not letting up its efforts to give hardworking Americans some breathing room,” said U.S. Secretary of Education Dr. Miguel A. Cardona. “As long as there are people with overwhelming student loan debt competing with basic needs such as food and healthcare, we will remain relentless in our pursuit to bring relief to millions across the country.”

The debt relief announced today is broken down into the following categories:

· $3.6 billion for 206,800 borrowers enrolled in the SAVE Plan who had smaller loans for their postsecondary studies. Borrowers can receive relief after at least 10 years of payments if they originally borrowed $12,000 or less for college. Each additional $1,000 in borrowing adds 12 more months until forgiveness. All borrowers on SAVE receive forgiveness after 20 or 25 years, depending on whether they have loans for graduate school.

· $3.5 billion for 65,700 borrowers through administrative adjustments to income-driven repayment (IDR) payment counts that have brought borrowers closer to forgiveness and address longstanding concerns with the misuse of forbearance by loan servicers.

· $300 million for 4,600 borrowers through fixes to Public Service Loan Forgiveness (PSLF). This update comes shortly after the Department announced new PSLF discharges a few weeks ago. The Administration has now approved $62.8 billion in forgiveness for almost 876,000 borrowers through PSLF.

Borrowers will receive emails informing them of their approvals, according to administration officials. Their relief will be processed in the weeks following.

Additionally, the administration recently released initial details of a new set of proposals for student debt relief that include: waiving accrued and capitalized interest for millions of borrowers; automatically discharging debt for borrowers otherwise eligible for loan forgiveness under SAVE, closed school discharge, or other forgiveness programs, but not enrolled; eliminating student debt for borrowers who entered repayment 20 or more years ago; helping borrowers who enrolled in low-financial-value programs or institutions; and assisting borrowers who experience hardship in paying back their loans.