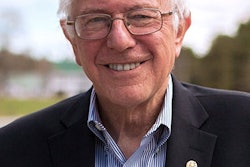

Randi Weingarten

Randi Weingarten

The 1.8 million-member teachers union claims that three weeks ago, education officials under the Trump administration removed application forms for income-driven repayment (IDR) plans from the department's website and secretly ordered loan servicers to halt all processing, effectively breaking the student loan system and violating federal law.

“By effectively freezing the nation's student loan system, the new administration seems intent on making life harder for working people, including for millions of borrowers who have taken on student debt so they can go to college,” said AFT President Randi Weingarten “The former president tried to fix the system for 45 million Americans, but the new president is breaking it again.”

The lawsuit, filed in federal court in Washington, D.C., seeks a court order to restore borrowers' access to IDR plans and Public Service Loan Forgiveness (PSLF). The union is represented by the Student Borrower Protection Center (SBPC) and Berger Montague PC.

Education Department officials have justified the sweeping action as a response to a February 18 decision by the Eighth Circuit Court of Appeals regarding the Saving on a Valuable Education (SAVE) repayment plan. However, critics argue the department has interpreted the ruling far too broadly, affecting multiple repayment programs that were created through bipartisan legislation dating back to 1992.

“Student loan borrowers are desperate for help, struggling to keep up with spiking monthly payments in a sinking economy, all while President Trump plays politics with the student loan system,” said Mike Pierce, SBPC Executive Director. “Borrowers have a legal right to payments they can afford and today we are demanding that these rights are enforced by a federal judge.”

The department's decision has reportedly created chaos for student loan servicing, leaving more than one million borrowers in an application backlog with no guidance on when their cases might be processed or when they might see relief. Many borrowers have reported sudden increases in their monthly payment amounts.

IDR plans are critical for many borrowers because they allow monthly payments to be calculated based on income and family size rather than standard loan amounts. For public service workers like teachers, nurses, and first responders, these plans are particularly important as they represent the only pathway to qualify for loan forgiveness through the PSLF program after 10 years of service.

The legal challenge highlights that the 2007 College Cost Reduction and Access Act, signed into law by President George W. Bush, created an IDR option that has never been successfully challenged in court and is not affected by any of the recent legal actions against other student loan programs. This option, known as Income-Based Repayment, was nonetheless halted when the administration removed all IDR applications.

“Congress required that the Department of Education offer IDR plans and provide borrowers access to these plans,” said E. Michelle Drake, Executive Shareholder at Berger Montague PC. “We look forward to restoring borrowers' access to these vital, necessary, and required programs.”

The situation has drawn criticism from lawmakers, with 25 U.S. Senators led by Bernie Sanders of Vermont and Ron Wyden or Oregon, sending a letter to Education Secretary Linda McMahon expressing concern over the department's actions.

The Education Department has not yet filed a formal response to the lawsuit, and officials declined to comment on pending litigation. The case represents the latest battle in the ongoing national debate over student loan debt, which affects approximately 45 million Americans who collectively owe $1.6 trillion.