That’s only a fraction of the potential cost to taxpayers if all the students affected by the collapse of Corinthian Colleges file claims. Education Department Under Secretary Ted Mitchell said the potential student loan relief could total $3.2 billion.

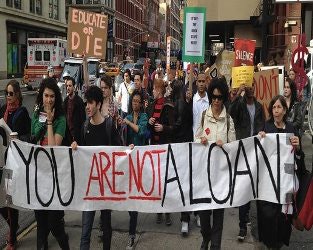

The claims already filed represent an unprecedented spike in what’s called a “borrower’s defense” claim following the collapse of Corinthian Colleges, a for-profit college chain that had become a symbol of fraud in the world of higher education. Department regulations allow students who believe they were victims of fraud to apply to have their loans discharged.

Officials say they knew of five or so such cases in the past 20 years; some 4,140 have been filed since the Education Department’s June announcement that it would make the debt-relief process easier. Officials say an additional 7,815 Corinthian students have filed claims for debt relief because their school closed.

Of those closed school claims, the department said 3,128 had been approved, totaling about $40 million in student loans.

The Obama administration is trying to rein in the for-profit college industry, which it says relies too heavily on federal student loans and often misleads students on job prospects. In its latest move, the Education Department on Aug. 28 sent a letter to DeVry University asking the for-profit institution for proof to support its job placement claims.

According to investigators, Corinthian schools charged exorbitant fees, lied about job prospects for its graduates and, in some cases, encouraged students to lie about their circumstances to get more federal aid. After the Education Department notified Corinthian that it would fine its Heald College $30 million for misleading students, the college chain filed for bankruptcy, with some 13,500 students still enrolled.

In a plan orchestrated by the federal government, some of the Corinthian schools closed while others were sold before the chain filed for bankruptcy this spring. The biggest question has been what should happen to the debt incurred by students whose schools were sold. The law already provides for debt relief for students of schools that close, so long as they apply within 120 days.

The latest plan expands debt relief to students who attended a now-closed school as far back as a year ago. And it streamlines the process for students whose schools were sold, but who believe they were victims of fraud.

In the report released Thursday by the Education Department’s new “special master” for debt relief, Joseph Smith, who called the collapse of Corinthian a “landmark event” that triggered an immediate 1,000 “borrower’s defense” claims and contributed to a claims list that now surpasses 4,000. Most of the claims are from Corinthian students, although some are from other schools.

While unprecedented, the figures actually represent a fraction of the students who might qualify for debt relief. Some 350,000 students have attended Corinthian schools in the past five years. The Education Department says it sent some 54,000 emails to Heald College students, alerting them about the program.