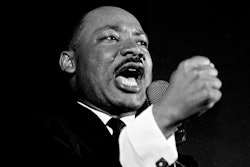

Dr. William Hudson Jr., vice president of student affairs at Florida A&M University, says “there are still a high number of people not being approved” for Parent PLUS Loans.

Dr. William Hudson Jr., vice president of student affairs at Florida A&M University, says “there are still a high number of people not being approved” for Parent PLUS Loans.The U.S. Department of Education’s decision to stand firm on its new, stricter credit criteria for families applying for Parent PLUS Loan (PPL) assistance to help their children through college is causing another year of frustration at many institutions, despite a department decision to reconsider all denied loan applications.

The government’s temporary denial reconsideration program has paid off for most who go the extra mile. Still, the significant decline in loan applications and the high initial rejection rate since the new credit rules took effect has many institutions worried that students are falling off the four-year college radar. For sure, at first glimpse, rejected families are not seeking reconsideration in large numbers.

Many institutions say they are working closely with the department in trying to follow up with families who have received denial notices. In the meantime, with final enrollment deadlines at hand, several institutions are scrambling for funds to help at-risk PPL students who are otherwise in good academic standing.

The loss of students is bad news in and of itself, if finances derail their college pursuits, school officials said. For the institutions, the loss of any students could impact enrollment at a time when institutions are under increasing political pressure to demonstrate progress in student retention and graduation.

“There are still a high number of people not being approved,” said Dr. William Hudson Jr., vice president of student affairs at Florida A&M University (FAMU), commenting on the university’s experience with families who applied for PPL for this fall. “It’s still high, still high,” said Hudson, echoing the sentiments of other administrators at several peer institutions aggressively trying to help students this fall.

FAMU, which lost nearly 500 tuition-short students last fall when their families’ PPL applications were denied, is working closely with the Department of Education to urge families denied loans this season to seek reconsideration, Hudson said.

Responding to intense criticism this spring and summer from across the nation’s higher education landscape after it rejected some 30,000 PPL applications for fall 2012, when its more rigid credit criteria took effect, the Department of Education said in late July it would review its new rules. In the interim, for the fall 2013 season, the department said it would review any loan application rejected under the new rules, if asked to do so.

A mid-August weekly review of the PPL program by the department found it had conducted 57,542 credit checks based on applications for loans for this fall. It denied 39,206 applications. It sent email notices to 9,812, or 25 percent, of those denied applications. Of the denied applications, 4,212 were submitted for reconsideration.

Of the requests for reconsideration, nearly 4,000 applications were approved.

The sample numbers are somewhat misleading, Department of Education and college officials acknowledge. Although individual institutions receive detailed weekly reports on the status of every PPL application submitted by a family on behalf of a student seeking to enroll in a respective school, the larger public reports are not clear on whether more than one application came from the same household and whether applications for denial reconsideration reflected more than one request per family.

Meanwhile, officials at several institutions and college support groups say, in addition to their concern about the falloff in applications, they figure the low rate of requests for reconsideration of loan denials stems from several factors. In some cases, parents have decided not to seek reconsideration since they feel they will be rejected again, an action they feel could worsen their credit standing.

Some people may be applying for a PPL knowing they will be rejected, as PPL denial is the only way a student, not parent, can apply for a smaller, lower interest (about half the cost of a PPL) federal “unsubsidized” loan. While those loans are capped at about $4,000, repayment does not begin immediately, as is the case for a PPL, and the child is more likely to be approved for the loan since they usually have little or no debt.

Also clouding the picture is the fact that some people still don’t realize there is a strong possibility they will be approved if they ask for reconsideration, despite strong assurances from the government and institution. They have opted out of the process, said several financial aid experts.

“Once you are denied recertification, you get tired and move on,” said Sharon Oliver, director of scholarships and student aid at North Carolina Central University (NCCU), identified in one PPL survey last year as having the highest PPL rejection rate in the nation.

Oliver said financial aid is a complicated process without added hurdles to clear. “It would be great, if they [the Department of Education] didn’t have two-step approval,” she said, referring to the need for a family denied a PPL to, in effect, reapply when they are asking for reconsideration of a denial determination.

“Just make it a seamless process,” said Oliver. “If you’re going to do the families a great benefit, you’ve got to do a one-step,” she said.

Like many of its peer institutions, NCCU has seen “a lot of denials,” for the fall 2013 semester, Oliver said. She said the denial and approval rate is like “a moving target,” as the federal gestures and intense efforts by specific institutions cause the number of students at risk of not being able to enroll to change constantly.

For example, Tennessee State University announced last week that it had raised more than $500,000 in just over seven days to pay at least the minimum amount required to keep some 350 students in good academic standing from being barred from enrolling this month for financial reasons. Most of the students were from families that had been denied PPL assistance and had run out of other options, the university said.

At Morgan State University in Baltimore, university officials have launched a $300,000 campaign to assist some 300 students from families where PPL assistance was denied. The effort has raised $70,000 to date, a university spokesperson said.

Howard University, which last year stepped up its scholarship fundraising efforts after more than 1,000 PPL loan applications were denied by the government, has continued that effort this school year, as the denial rate for that institution for fall 2013 enrollees has improved only slightly.

Alabama A&M University, which saw 1,454, or 74 percent, of its PPL application denied this time ago, is hoping the denial reconsideration gesture from the Department of Education will work this year.

Alabama A&M expects nearly 2,000 PPL applications will be submitted to the government this year. To date, 428 of those received have been denied. Of those, 139 families requested reconsideration. All but one application was approved upon reconsideration, and the university expects the other to be accepted upon reconsideration, said Darryl Jackson, director of student aid at the university.

“We’re hopeful for an uptick in approvals,” based on the new reconsideration program, said Jackson, adding it will be several weeks before the university gets a full picture of the fall PPL experience.

Several institutions, including FAMU and NCCU, are using their college websites to supplement letters and phone calls to specific families denied PPL assistance, urging them to request reconsideration.

“It’s definitely impacting their [institutions’] enrollment, and they’re being stretched to find ways to bring their students back,” said Attorney Johnny Taylor, president and CEO of the Thurgood Marshall College Fund, offering an overall assessment of the continuing PPL situation on historically Black colleges and universities, his target audience.