WASHINGTON — Citing a series of policies and practices that have historically stripped Black people in the nation’s capital of the ability to accumulate wealth, a bevy of scholars presented groundbreaking data Tuesday that shows disturbing disparities between the net worth of Black and White dwellers in the city.

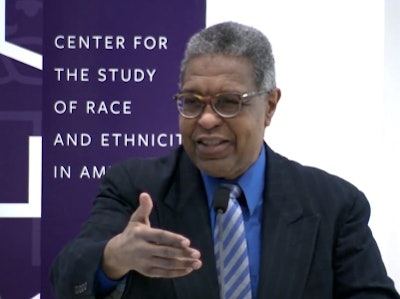

Dr. William A. Darity is a primary investigator for the report and the Samuel DuBois Cook Professor of Public Policy at Duke University.

Dr. William A. Darity is a primary investigator for the report and the Samuel DuBois Cook Professor of Public Policy at Duke University.The typical White household in Washington, D.C., in 2013 and 2014 had a net worth of $284,000 — a whopping 81 times greater than that of the typical Black household in the city, which had a net worth of $3,500, according to the report, “The Color of Wealth in the Nation’s Capital.”

The report transcends the typical Black-White dynamic in that it drills down on the data to give a more granular picture of wealth in Washington by the race and ethnicity of several groups and even subgroups. It also shines light on the role that things that range from higher education to homeownership do or don’t do to help people to achieve socioeconomic equity.

The scholars chose to focus on wealth — not income — because it provides a more meaningful picture of who has assets that can be converted into cash if need be versus who is saddled with debilitating debt.

“We argue that research that emphasizes income or occupational stature or education will be inadequate if it doesn’t pay attention to wealth position in households,” said Dr. William A. Darity, a primary investigator for the report and the Samuel DuBois Cook Professor of Public Policy at Duke University.

The report delves into the history of the nation’s capital and deals with the impact that practices ranging from slaveholding in the 18th and 19th centuries to redlining in the 20th century and now gentrification in the 21st century has had on Washington Blacks’ ability to accumulate or maintain wealth.

Kilolo Kijakazi, a fellow at the Urban Institute and a key collaborator on the report, rattled off a litany practices that she defined as “structural racism.” Her list included requiring Black people to pay taxes but forbidding them to attend public schools, thus causing them to “pay again” to build and be educated in private schools, to preventing Blacks from attending White colleges and universities such as Georgetown, which profited from the slave trade itself.

More recent examples included targeting Black neighborhoods with subprime loans, “further stripping them of wealth and their homes.”

“Any assertion that the racial wealth gap can be eliminated with behavioral changes on the part of Black people, rather than addressing structural racism, is fundamentally flawed,” Kijakazi said.

The “Color of Wealth” report is rich in data that illuminates wealth disparities not just in terms of money in the bank but stocks and investment funds, home values, medical debt and student loan debt, to name a few.

Of all the charts and tables in the report, one of the more compelling ones breaks down college degree attainment, marriage and median family income by race and ethnicity. Whereas Blacks are typically looked at as a group, African-born Blacks and U.S.-born Blacks are looked at separately. And whereas Asians are usually lumped into one category, the report looks at Chinese, Koreans, Vietnamese and Asian Indians separately.

Notably, U.S.-born Blacks in D.C. have the lowest bachelor’s degree attainment rates — at 45.4 percent — as well as the lowest marriage rate — at 29.8 percent. However, U.S.-born Blacks in D.C. tend to out-earn African-born Blacks — $72,000 per family versus $59,000 per family — even though African-born Blacks in D.C. have higher bachelor’s degree attainment and marriage rates, at 66.4 and 53 percent, respectively.

Public sector jobs in the nation’s capital are believed to play a role in the fact that U.S.-born Blacks do comparatively well without a high rate of bachelor’s degree attainment, Darity said.

Darrick Hamilton, also a primary investigator and an associate professor of economics and urban policy at The New School, said it’s important not to look at U.S.-born Black marriage and bachelor’s degree attainment rates in isolation, but rather in a broader context that includes high incarceration rates for Black men. He also said it’s important not to let the statistics become defeating.

“Don’t take this as a dismal thing that paralyzes us,” Hamilton said. “There’s stuff we can do about it,” he said, citing previous works that have shown government policy created an asset-based White middle class.

The report recommends a number of policy prescriptions and programs to eliminate the racial wealth gap — from protections against predatory lending to a federal job guarantee to “baby bonds,” child trust accounts in which newborns in the lowest-income families receive the largest accounts.

Darity said it will take a massive redistribution of wealth to turn things around. Earning college degrees or starting businesses have proven ineffective at doing the job, he said, noting that degrees may improve Blacks’ position relative to other Blacks, but not to Whites in general. He also noted that there are some businesses on Forbes’ top business list that have more wealth than all Black businesses combined.

“The only way we can alter the wealth position of the Black community is by a massive wealth redistribution program,” Darity said, noting that even starting a business requires access to money. “Unless there’s an intervention to alter the distribution of wealth at the core, there’s not gonna be a change by either education or increasing self-employment.”

Jamaal Abdul-Alim can be reached at [email protected] or you can follow him on Twitter @dcwriter360.