Student loan rates will double to 6.8 percent.

Student loan rates will double to 6.8 percent.With college loan debt already at record levels, 7 million students will see their finances take another hit this week as interest rates on many federally subsidized loans double to 6.8 percent.

Congress is allowing the rate hike to take effect by failing to halt the increase before leaving for its July 4 vacation. The House and Senate faced the same dilemma last year but prevented the increase in the wake of an upcoming presidential election. But one year later, lawmakers could not reach a bipartisan agreement to maintain the low rate of 3.4 percent.

Most Democrats and President Obama argued for another short-term extension to give Congress more time to fix the problem. But many Republicans favored taking rate-setting away from politicians and switching it to market rates. Student groups and many lawmakers are wary of any market-based plan that lacks an interest rate ceiling, or other protections, for the future.

“Both parties agree on the need for a comprehensive overhaul to make our financial aid system more effective, affordable, and sustainable. But Republicans see the deadline as a chance to cram through a long-term bill that would keep rates low for a year or so but then in successive years make college more expensive for working families,” said Sen. Jack Reed, D-R.I.

Reed, Sen. Kay Hagan, D-N.C., and more than 30 senators have proposed legislation to keep the 3.4 percent rate for another year, giving Congress more time to find a solution. It is scheduled to be considered by the Senate when it returns to work July 10.

The GOP-led House of Representatives approved a bill to switch to market rates in May by a largely party line vote. Rep. John Kline, D-Minn., chairman of the House education committee, criticized Democrats for letting the increase take effect, saying he was “stunned” that the Democrat-controlled Senate left town without a solution.

“We had a real opportunity for compromise on an issue affecting millions of young people,” he said.

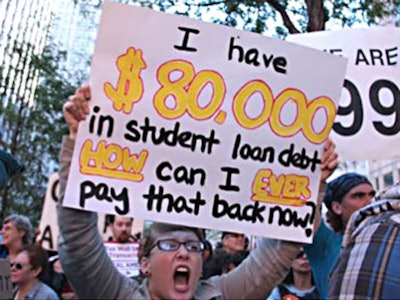

The rate hike comes as the nation has record amounts of college loan borrowing. Outstanding student loan debt totaled $986 billion in March, the Federal Reserve Bank of New York reported. That figure was up $20 billion at the end of 2012.

The Institute for College Access and Success (TICAS), which supports college access measures, says the GOP’s proposed switch to market rates – without interest rate protection – would cause major increases for students within three years given an improved economy.

“Comprehensive student loan reform must result in lower student debt levels than what borrowers would carry as a result of current policy,” states a letter signed by TICAS, the AFL-CIO and Education Trust.

The increase would affect the interest rate on subsidized Stafford Loans, which are heavily used by undergraduates with financial need.